Ford Feels Pressure of China Rivals' Pursuit

August 28 2016 - 5:05AM

Dow Jones News

SHANGHAI--When Ford Motor Co. launched the Kuga crossover in

China in 2013, drivers paid extra to have their cars delivered as

soon as possible. Three years later, a backlog of unsold Kugas is

starting to stack up on dealership lots, auto retailers say.

"Even a 20% discount isn't appealing enough" to entice

customers, said Zhang Hui, a small car trader in central Henan

province. Ford sold 18% fewer Kugas in the first half compared with

a year earlier.

Auto makers are under pressure to offer unique products or

services if they want to maintain their share of China's market.

This is particularly acute for Ford, a relative latecomer to China,

because it lags behind rivals Volkswagen AG and General Motors Co.

in terms of product lineup and brand image there, analysts say, as

domestic auto makers are gaining traction.

The Kuga's relatively fast deceleration from being a top seller

in China illustrates the challenges facing foreign auto makers in

the world's biggest auto market, where growth is moderating and

domestic rivals are offering cars with similar technology at lower

prices, putting a squeeze on companies' profit margins. China's

top-selling SUV in the first seven months of the year was Great

Wall Motor Co.'s Haval H6, which starts at under $14,000.

"We're seeing a lot of competition from the domestics that are

really coming up strongly and with really better products," Robert

Shanks, chief financial officer at Ford said on a recent conference

call. The company is responding to declining market share with

several new-model launches in the back half of the year.

This includes a revamped Kuga that has a new grille design, a

more fuel-efficient engine, and a new communications system.

"These are all good selling points. But I dare not say it will

be a certain success," said Xie Zhaohan, an analyst at Ways

Consulting Co. "The small and compact crossover segment is

saturated, and Chinese consumers prefer bigger crossovers to

accommodate their extended families."

China's new-car sales roared from two million vehicles in 2000

to more than 24 million in 2015, but now auto makers are cooling

their ambitions. Toyota Motor Corp. said earlier this year that it

is uncertain about hitting a target it set two years ago to sell

two million cars in China by 2025. Jochem Heizmann, head of

Volkswagen's China operations, said this month that he expects

slower growth in the second half and warned that the expiration

this year of a tax break on small-engine vehicles left an unclear

picture for next year, given that the incentive is helping drive

demand.

Ford unveiled four years ago an ambitious $5 billion plan to

double its production capacity in China by 2015, but it has had

difficulties in the past few months, as noted by senior management

on a recent conference call.

Its Asia-Pacific region, which includes China, swung to an $8

million pretax loss in the second quarter of 2016--its first loss

in the region in 13 quarters--amid a sales decline in China and

weaker pricing. Its China joint venture saw a 28% income drop in

the second quarter, compared with an 8% rise for rival Volkswagen,

although both companies derived lower joint-venture income across

the first half.

A Ford spokesman said the quarterly slide was due to an

eight-week shutdown of one of its plants in southwestern city of

Chongqing for facility upgrades that resulted in 40,000 units of

lost production.

There are bright spots for Ford. First-half sales of its Lincoln

Motor Co. brand in China nearly tripled those of the same period

last year, and the Edge, a higher-end crossover launched last year

and aimed at a different market from the Kuga, has become Ford's

best-selling crossover.

Keeping dealer networks happy in China is another challenge. One

manager of a network of dealerships including Volkswagen, Ford,

Mercedes-Benz and Land Rover based in the southeast city of Wenzhou

said he doesn't feel incentivized enough to sell Ford cars because

sales targets are too high, prompting dealers to heavily discount

cars. "If I can't achieve 100% of the sales target, the bonus won't

be enough to cover my losses," said the dealer, who declined to be

named.

He says he has a Ford inventory level of about 2.2 months of

sales, well above the 1.5 level that is regarded as unhealthy in

China. "When the market was booming, it wasn't very difficult. Now,

it's very difficult," he said.

Ford's spokesman said that the company was happy with its

inventory levels in China, and continues "to work with our dealers

to provide customers with the most clear and compelling offers in

the marketplace."

But the pressure is growing on Ford and its rivals to maintain

share. "Chinese consumers are less loyal to brands than people in

the West," said Peng Bo, a partner with the global strategy

consulting team at PricewaterhouseCoopers.

Rose Yu in Shanghai and Christina Rogers in Detroit

(END) Dow Jones Newswires

August 28, 2016 04:50 ET (08:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

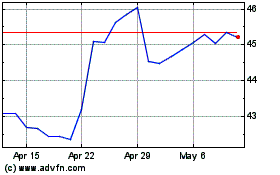

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

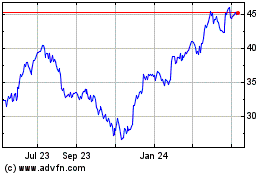

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024