Tempur Sealy Shares Fall as Mattress Firm Cuts 2016 Outlook

September 27 2016 - 7:30PM

Dow Jones News

Tempur Sealy International Inc. shares fell after the mattress

company lowered its 2016 guidance, saying sales in the current

quarter have been weaker than expected.

The Lexington, Ky., company's shares dropped 24% to $56.29 in

recent after-hours trading.

Tempur Sealy reduced its 2016 outlook for adjusted earnings

before interest, taxes, depreciation and amortization by $25

million and now expected adjusted Ebidta of $500 million to $525

million. The company also projected a decline in net sales of

between 1% and 3% for the year, compared with its previous estimate

for net sales to increase in the low single digits.

Chairman and Chief Executive Scott Thompson, who have been

aiming to lower costs and boost margins at the company, said in

prepared remarks Tuesday that "while our net sales are below

expectations, our operational initiatives are going well and are

continuing to drive considerable margin expansion."

Mr. Thompson has been CEO for roughly a year and was brought in

by activist investor H Partners Management LLC, which—among other

things—had criticized Tempur Sealy for falling profit margins.

Tempur Sealy released its updated guidance ahead of a financial

conference Tuesday in Phoenix.

The company plans to release its third-quarter results on Oct.

27.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

September 27, 2016 19:15 ET (23:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

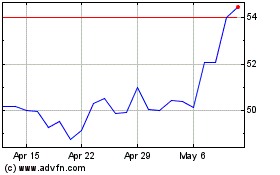

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

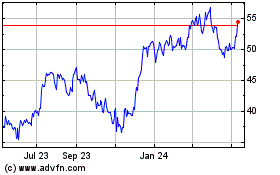

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Apr 2023 to Apr 2024