Dollar Mixed After U.S. Consumer Prices; Fed Decision Awaited

March 15 2017 - 5:39AM

RTTF2

The U.S. dollar was trading mixed against its major counterparts

in the European session on Wednesday, after data showed that the

U.S. consumer price inflation and retail sales rose in line with

forecasts in February. The Federal Reserve wraps up its two-day

meeting later in the day, with a quarter percentage point rate hike

almost certain.

The Labor Department released a report showing a modest uptick

in U.S. consumer prices in February, as a drop in gasoline prices

partly offset increases in prices for food, shelter and

recreation.

The Labor Department said its consumer price index inched up by

0.1 percent in February after climbing by 0.6 percent in January.

The uptick in prices matched economist estimates.

Data released by the Commerce Department showed that U.S. retail

sales rose modestly in February, with the uptick in sales matching

economist estimates.

The Commerce Department said retail sales inched up by 0.1

percent in February after climbing by an upwardly revised 0.6

percent in January.

Economists had expected sales to creep up by 0.1 percent

compared to the 0.4 percent increase originally reported for the

previous month.

Investors focus on the FOMC decision, due at 2:00 pm ET, when

the bank is widely expected to increase benchmark rate by 0.25

percent to a range of 0.75 percent - 1 percent. The Fed statement

is likely to be watched for further clarity on the bank's interest

rate plans for the rest the year.

Fed Chairwoman Janet Yellen will hold a press conference at 2:30

pm ET, when she will give an update on the U.S. economy.

The currency was trading lower in the Asian session, weighed by

a fall in U.S. treasury yields.

The greenback that declined to 114.56 against the Japanese yen

at 7:45 am ET rebounded modestly to 114.76 following the data.

Figures from the Ministry of Economy, Trade and Industry showed

that Japan's industrial production declined less than initially

estimated in January.

Industrial production fell 0.4 percent month-over-month in

January instead of a 0.8 percent drop estimated earlier. It was the

first decline in six months.

The greenback held steady around 1.0623 against the euro, after

rebounding from a low of 1.0639 hit at 3:45 am ET. The pair was

valued at 1.0604 when it finished Tuesday's trading.

European Central Bank Executive Board member Peter Praet said

that euro area inflation is being driven by energy and food prices

and underlying price pressures remain subdued, implying that there

was no need for a change in the current monetary policy stance.

"Looking through recent volatility, the inflation outlook does

not at this stage warrant a reassessment of the current monetary

policy stance," Praet said in a panel discussion at the G-20

conference in Frankfurt.

Following a decline to 1.0074 against the Swiss franc at 4:05 am

ET, the greenback rebounded to 1.0096 and held steady in the course

of the trading session. The pair finished yesterday's trading at

1.0101.

After having fallen to a 9-day low of 1.2255 against the pound

at 2:00 am ET, the greenback reversed direction shortly and held

steady around 1.2196. At Tuesday's close, the pair was valued at

1.2153.

Data from the Office for National Statistics showed that the UK

jobless rate fell to the lowest level since 1975 at the start of

the year.

The ILO unemployment rate came in at 4.7 percent in three months

to January versus 5.1 percent seen a year earlier.

The U.S. NAHB housing market index for March and business

inventories for January are due shortly.

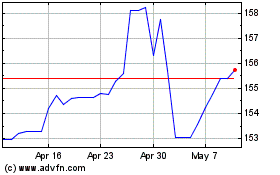

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

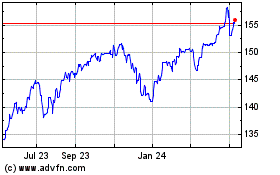

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024