By Barbara Kollmeyer and Anora Mahmudova, MarketWatch

Micron Technology jumps to new 52-week high after earnings

U.S. stock-market indexes pared earlier Friday gains, pushing

the Dow industrials in to negative territory, as investors grew

anxious about a pending House vote on a key health-care

legislation.

Markets pivoted lower on reports that the House Speaker Paul

Ryan went to the White House

(http://www.marketwatch.com/story/speaker-ryan-going-to-white-house-ahead-of-planned-health-vote-2017-03-24)

to meet with President Donald Trump, which was being interpreted by

some as a bad sign for the passage of the bill.

The Dow Jones Industrial Average was bouncing around in

afternoon trade, most recently up 12 points, or less than 0.1%, at

20,667, after briefly turning negative as news flowed out of

Washington around the vote. Goldman Sachs Group Inc. (GS) weighed

on the blue-chip gauge, down more than 1%, and cutting nearly 20

points.

The S&P 500 index was up by 6 points, or 0.3%, to 2,351,

with eight of the 11 main sectors trading higher. Seen as a

defensive investment, utility stocks were up 0.6% to lead the

S&P 500's sectors.

The tech-heavy Nasdaq Composite Index was up 31 points, or 0.5%,

to 5,848.

All three main indexes looked set for weekly losses of about 1%,

their biggest since the week ended Dec. 30, according to FactSet

data.

"At a time when the S&P 500 is trading above its fair value

if you consider a forecast of $130 earnings per share on a 17-times

multiple, Wall Street would really like to be reassured about the

tax reforms," said Kim Caughey Forrest, senior analyst and

portfolio manager at Fort Pitt Capital Group.

Kate Warne, investment strategist at Edward Jones, said the

"inability of the Congress to pass the health-care bill would send

a signal that other policies, such as tax reforms may be delayed

too. The weakness over the past week is a reflection of such

concerns."

Voting on health-care legislation that would replace the

Affordable Care Act, widely known as Obamacare, is scheduled for

late-afternoon Friday. It was postponed from Thursday night after

its Republican backers failed to win over the bill's opponents

within their own party.

Read:Here's what the health-care vote means for financial

markets

(http://www.marketwatch.com/story/what-traders-are-watching-as-health-care-vote-looms-2017-03-23)

Market reaction to durable-good orders

(http://www.marketwatch.com/story/orders-for-durable-goods-post-second-straight-gain-2017-03-24)was

muted.

Need to know:The Trump rally's not over--at least until this

danger sign flashes

(http://www.marketwatch.com/story/the-trump-rallys-not-over-at-least-until-this-danger-sign-flashes-2017-03-24)

But modest gains on Friday were attributed to Trump playing

hardball on the health-care vote.

"In a shock-and-awe move, at least for us, President Trump

raised the stakes by declaring that should the bill get voted down

today, he is prepared to leave Obamacare in place and move on to

tax reform," IronFX analysts Marios Hadjikyriacos and Charalambos

Pissouros told clients in a note.

Read:Trump's ultimatum--pass health bill now or live with

Obamacare

(http://www.marketwatch.com/story/trump-ultimatum-pass-health-bill-now-or-live-with-obamacare-2017-03-23)

Economic docket and Fed speakers: New orders for durable goods

climbed 1.7% in February, rising for the second straight month.

Meanwhile, St. Louis Fed President James Bullard said U.S. labor

market improvement is slowing down, speaking at the Economic Club

of Memphis at 9:05 a.m. Eastern. New York Fed President William

Dudley will speak at a fireside chat at the York College, City

University of New York with questions from the audience starting at

10 a.m. Eastern Time.

Late Thursday, Dallas Federal Reserve President Robert Kaplan

said

(http://www.marketwatch.com/story/feds-kaplan-wants-gradual-rate-hikes-but-doesnt-expect-pause-in-policy-track-2017-03-23)

he wants a "gradual and patient" approach to raising interest rates

this year but that that doesn't necessarily include a "pause" in

the Fed's rate-tightening policy.

Stocks to watch: Shares of Micron Technology Inc.(MU) jumped

more than 11% to set a new 52-week high at $29.87 at the open after

guidance for the current quarter exceeded analysts' estimates late

Thursday.

Read:Micron profits from memory shortage, expects party to

continue

(http://www.marketwatch.com/story/micron-profits-from-memory-price-spike-expects-party-to-continue-2017-03-23)

Twitter Inc. (TWTR) rose 2.5% after a report the online news and

social-networking service is exploring a subscription-based premium

service for professionals

(Twitter%20Inc.%20is%20exploring%20a%20subscription-based%20premium%20service%20for%20professionals,%20which%20could%20create%20an%20important%20new%20revenue%20stream%20for%20the%20beleaguered%20company.),

which could open up a new revenue stream for the beleaguered

company.

GamesStop Corp.(GME) shares tumbled 12% after the videogame

retail chain said it would close at least 150 stores

(http://www.marketwatch.com/story/gamestop-to-shut-at-least-150-stores-shares-sink-2017-03-23).

SeaWorld Entertainment Inc.(SEAS) said Friday it would sell a

21% stake held by affiliates of Blackstone Group L.P

(http://www.marketwatch.com/story/blackstone-to-sell-its-seaworld-stake-to-chinas-zhonghong-at-a-33-premium-to-market-prices-2017-03-24).(BX)

to a unit of China's Zhonghong Zhuoye Group Co. Ltd. for $23 a

share, a 33% premium to Thursday's closing price of $17.31. Shares

rose 7.7% to $18.64.

Other markets: Several Asian stock markets

(http://www.marketwatch.com/story/asia-pacific-markets-pick-up-speed-despite-delay-on-us-health-care-bill-2017-03-23)

gained amid cautious optimism ahead of the final health-care vote.

European stock markets were sagging, with the FTSE 100 set for the

worst week since January.

The dollar firmed up against the yen, but eased against the

euro. The shared European currency jumped after eurozone flash PMIs

beat forecasts. Oil prices rose slightly, while gold eased.

(END) Dow Jones Newswires

March 24, 2017 12:41 ET (16:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

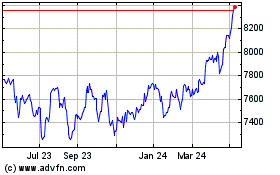

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

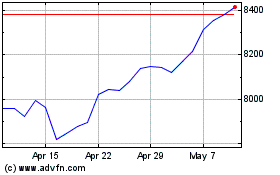

FTSE 100

Index Chart

From Apr 2023 to Apr 2024